Introduction to Modern Investment Platforms

Digital investment platforms have revolutionized how people approach wealth building and financial planning. Moreover, these platforms provide accessible tools for both beginners and experienced investors. LessInvest.com stands out as a comprehensive solution that combines educational resources with practical investment tools. Furthermore, the platform offers users multiple ways to diversify their portfolios and achieve long-term financial goals.

Investment platforms like this one eliminate traditional barriers that once prevented average investors from accessing professional-grade tools. Additionally, they provide real-time market data, analytical tools, and educational content in one convenient location. Subsequently, users can make informed decisions about their financial future without requiring extensive market knowledge.

Platform Overview and Core Features

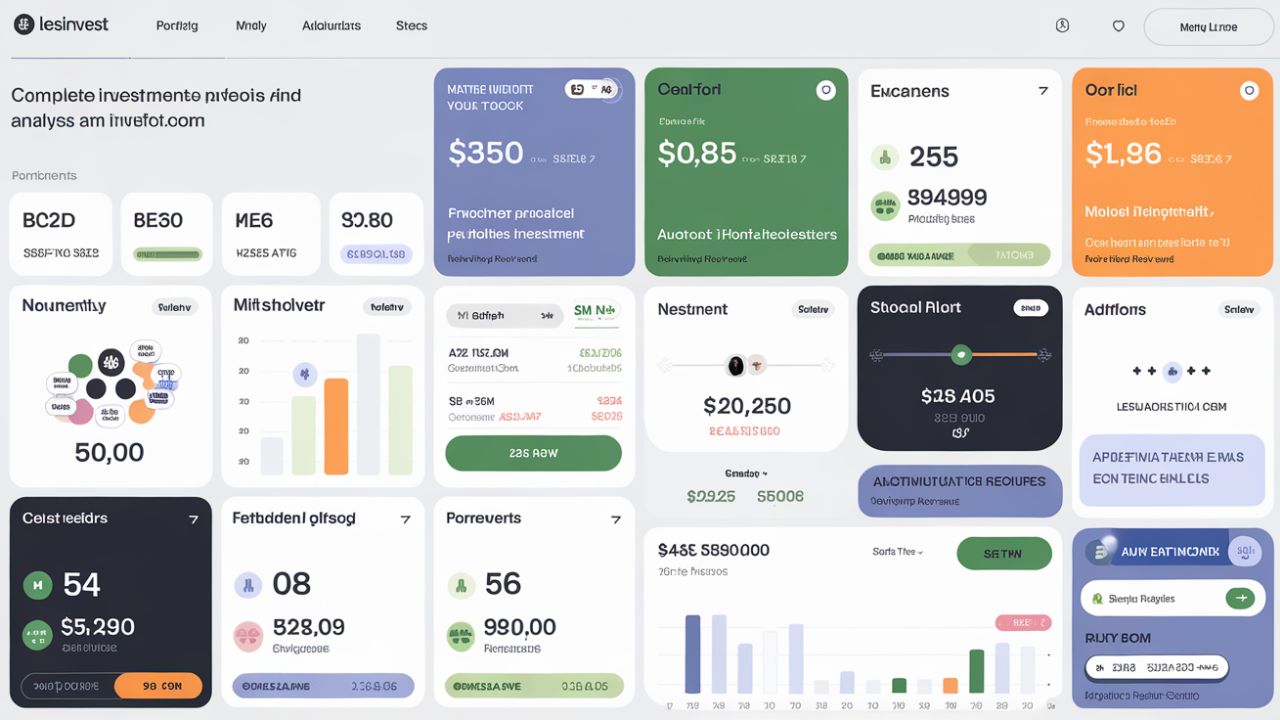

The platform presents a user-friendly interface that simplifies complex investment concepts for everyday users. Specifically, it offers portfolio tracking, market analysis, and educational resources through an intuitive dashboard. Meanwhile, advanced users can access sophisticated analytical tools and customizable investment strategies.

Portfolio management tools allow users to monitor their investments across multiple asset classes simultaneously. Consequently, investors can maintain diversified portfolios while tracking performance metrics in real-time. Additionally, the platform provides automated rebalancing features that help maintain optimal asset allocation ratios.

Educational resources form a cornerstone of the platform’s value proposition for new investors. Therefore, users can access webinars, tutorials, and market insights that enhance their investment knowledge. Furthermore, these resources cover topics ranging from basic investment principles to advanced trading strategies.

Investment Tools and Analytics

Advanced charting tools provide users with comprehensive market analysis capabilities for informed decision-making. Similarly, the platform offers technical indicators that help identify potential investment opportunities and market trends. Moreover, users can customize their analytical workspace to focus on specific metrics that align with their investment style.

Risk assessment tools help investors understand potential downsides before committing capital to specific investments. Consequently, users can make more calculated decisions that align with their risk tolerance and financial objectives. Additionally, the platform provides stress testing features that simulate portfolio performance under various market conditions.

Performance tracking features allow users to monitor returns across different time periods and asset classes. Subsequently, investors can identify which strategies work best for their specific financial situation and goals. Furthermore, comparative analysis tools help users benchmark their performance against relevant market indices.

Educational Resources and Learning Opportunities

Comprehensive educational content helps beginners understand fundamental investment principles and market dynamics effectively. Additionally, the platform offers structured learning paths that guide users through increasingly complex investment concepts. Moreover, interactive tutorials provide hands-on experience with various investment tools and strategies.

Webinar series feature industry experts who share insights about current market conditions and investment opportunities. Therefore, users can learn from experienced professionals while staying updated on market developments. Furthermore, recorded sessions allow users to review content at their convenience and revisit important concepts.

Market research reports provide in-depth analysis of various sectors, helping users identify potential investment opportunities. Consequently, investors can make more informed decisions based on professional research and analysis. Additionally, these reports often include actionable recommendations that users can incorporate into their investment strategies.

User Experience and Interface Design

The platform prioritizes user experience through intuitive navigation and clean visual design that reduces complexity. Meanwhile, customizable dashboards allow users to organize information according to their specific needs and preferences. Subsequently, both novice and experienced investors can efficiently access the tools they need most frequently.

Mobile applications ensure users can monitor their investments and access educational content from anywhere. Therefore, investors can stay connected to their portfolios and market developments throughout the day. Furthermore, push notifications keep users informed about important market events and portfolio changes.

Account setup processes are streamlined to minimize friction while ensuring proper security measures are implemented. Additionally, the platform provides step-by-step guidance that helps new users navigate initial setup procedures. Moreover, customer support resources are readily available to assist users with any technical difficulties.

Security and Regulatory Compliance

Financial security measures protect user data and investment funds through multiple layers of encryption and authentication. Specifically, the platform employs bank-level security protocols to safeguard sensitive financial information. Moreover, regular security audits ensure that protective measures remain current with evolving cybersecurity threats.

Regulatory compliance demonstrates the platform’s commitment to operating within established financial industry standards and regulations. Consequently, users can trust that their investments are handled according to proper legal and ethical guidelines. Additionally, transparent reporting practices provide users with clear information about fees, risks, and investment performance.

Insurance coverage protects user accounts against certain types of losses, providing additional peace of mind. Therefore, investors can focus on building wealth without worrying about platform-related security issues. Furthermore, the platform maintains relationships with reputable financial institutions to ensure proper fund custody.

Investment Strategy Development

Goal-setting tools help users define clear financial objectives and create actionable plans for achieving them. Subsequently, the platform can recommend appropriate investment strategies based on individual risk tolerance and timelines. Moreover, regular progress tracking ensures users stay on course toward their financial goals.

Diversification guidance helps users spread risk across multiple asset classes and investment vehicles effectively. Therefore, investors can build more resilient portfolios that can weather various market conditions. Additionally, the platform provides educational content about correlation between different asset types.

Rebalancing recommendations help users maintain optimal portfolio allocation as market conditions change over time. Consequently, investors can preserve their intended risk profile while capturing opportunities for enhanced returns. Furthermore, automated rebalancing features can execute these adjustments without requiring constant user intervention.

Cost Structure and Fee Transparency

Transparent fee structures ensure users understand all costs associated with using the platform and its services. Additionally, the platform provides detailed breakdowns of management fees, transaction costs, and any additional charges. Moreover, fee calculators help users estimate total costs before committing to specific investment strategies.

Competitive pricing makes professional-grade investment tools accessible to investors with various budget constraints and account sizes. Therefore, users can access sophisticated features without paying excessive fees that erode investment returns. Furthermore, volume discounts may be available for users with larger account balances.

No hidden fees policy ensures users won’t encounter unexpected charges that weren’t clearly disclosed upfront. Consequently, investors can budget appropriately and calculate accurate net returns on their investments. Additionally, regular fee schedules are published and updated to maintain transparency.

Customer Support and Community Features

Dedicated customer support teams provide assistance with technical issues, account questions, and platform navigation guidance. Meanwhile, multiple contact methods ensure users can reach support through their preferred communication channels. Subsequently, most issues are resolved quickly without disrupting users’ investment activities.

Community forums allow users to share experiences, ask questions, and learn from other investors’ successes and mistakes. Therefore, the platform fosters a collaborative environment where knowledge sharing benefits all participants. Furthermore, moderated discussions ensure content remains helpful and appropriate.

Expert consultations provide personalized advice for users who need guidance with complex investment decisions or strategies. Additionally, these sessions can help users optimize their portfolios based on changing life circumstances or market conditions. Moreover, scheduling flexibility accommodates users’ busy schedules and time zone differences.

Performance Metrics and Reporting

Comprehensive performance reports provide detailed analysis of portfolio returns, risk metrics, and benchmark comparisons over time. Specifically, users can track performance across daily, monthly, quarterly, and annual periods. Moreover, customizable reporting features allow users to focus on metrics most relevant to their investment goals.

Tax reporting tools simplify year-end tax preparation by organizing investment-related transactions and generating necessary documentation. Consequently, users can efficiently manage tax obligations while maximizing after-tax returns on their investments. Additionally, the platform may integrate with popular tax preparation software for seamless data transfer.

Benchmark comparisons help users evaluate their investment performance relative to relevant market indices and peer groups. Therefore, investors can assess whether their strategies are generating appropriate returns for the level of risk taken. Furthermore, historical performance data provides context for evaluating long-term investment success.

Technology and Innovation

Cutting-edge technology powers the platform’s analytical capabilities and ensures fast, reliable access to market data. Meanwhile, regular updates introduce new features and improvements based on user feedback and market developments. Subsequently, users benefit from continuous enhancements without additional costs or complex upgrade procedures.

Artificial intelligence tools help identify investment opportunities and provide personalized recommendations based on user preferences and goals. Therefore, even novice investors can benefit from sophisticated analytical capabilities that were previously available only to professionals. Furthermore, machine learning algorithms continuously improve recommendation accuracy over time.

Integration capabilities allow users to connect external accounts and consolidate their financial information in one location. Additionally, API access may be available for users who want to integrate platform data with other financial tools. Moreover, data export features ensure users maintain control over their investment information.

Future Development and Expansion Plans

Ongoing platform development focuses on expanding educational resources and introducing new investment tools and features. Additionally, user feedback guides development priorities to ensure new features address real investor needs and preferences. Moreover, regular feature releases keep the platform current with evolving market conditions and user expectations.

International expansion plans may bring the platform’s services to new markets and geographic regions over time. Therefore, global investors might gain access to these tools and resources in the future. Furthermore, regulatory compliance in new jurisdictions ensures proper operation according to local financial laws.

Partnership opportunities with financial advisors, educational institutions, and other service providers enhance the platform’s value proposition. Consequently, users may gain access to additional resources and services that complement their investment activities. Additionally, strategic alliances can provide specialized expertise in niche investment areas.

Conclusion and Final Recommendations

Investment platforms like this one democratize access to professional-grade tools and educational resources for investors worldwide. Moreover, comprehensive features support users throughout their investment journey, from initial learning to advanced portfolio management. Therefore, both beginners and experienced investors can benefit from the platform’s diverse capabilities and resources.

Success with any investment platform requires commitment to learning, consistent application of sound investment principles, and patience. Additionally, users should take advantage of educational resources and start with conservative strategies before progressing to more complex approaches. Furthermore, regular portfolio reviews and adjustments help ensure investments remain aligned with changing goals and market conditions.

The combination of user-friendly design, comprehensive features, and educational support makes this platform a valuable tool for building wealth. Consequently, investors who actively engage with available resources and maintain disciplined investment approaches are likely to achieve their financial objectives over time.